A pragmatic approach to shaping and shipping digital products

A culture of innovation, a bias for action, and strong opinions loosely held

Dedicated, integrated teams of product strategists, delivery managers, designers, and software engineers

Highly collaborative relationships built on trust and transparency

Actionable insights, tangible concepts and testable prototypes

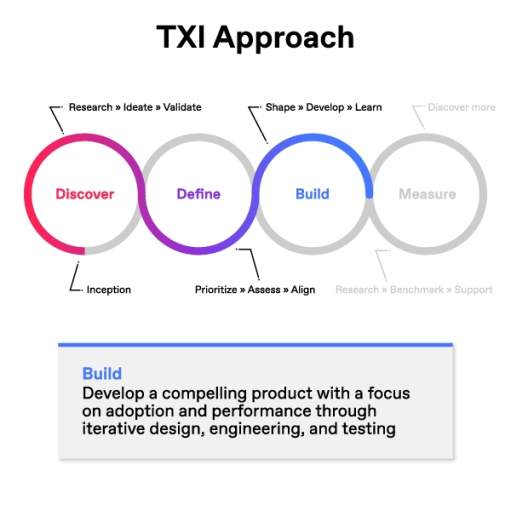

Our approach

TXI is the strategic partner helping you build conviction, drive change, and achieve outcomes through digital product innovation. We build software to solve your unique and complex problems while improving people's lives and work, giving your organization a competitive advantage.

Experience TXI

A commitment to accessibility and best-in-class user experiences

Exquisite, highly performant code, and open-source software

Product validation, market fit, and user desirability

Marketing support and product management

Upskilling opportunities for your teams through pairing and trainings

I’ve been very impressed with TXI’s adaptability. We created something new to the industry, a framework for innovation.

Inception

For ambitious and/or ambiguous endeavors, this optional pre-discovery work helps us identify risk, the implications of existing resources and research, and the decision maker(s) for the work ahead. We believe the traditional RFP process is broken and benefits neither party. Inception is our antidote to “take their money and run.” Inception (sometimes called phase zero) allows us to learn as much as we can about your team, your goals, and the nature of the work itself.

Our intellectual curiosity runs deep. So it’s an opportunity to get smart quickly, familiarize ourselves with the problem space, and understand your constraints and ambitions—ahead of the engagement itself. You and your other executive decision-makers work closely with our Client Partners and team leads in a series of focused work sessions to help uncover deeper strategic drivers behind the product and understand the thinking behind your project scope or RFP.

When we’re in inception mode, we answer questions like:

How might we reframe or sharpen the original ‘ask’ to best reflect what’s ultimately driving this work?

How might we collaboratively fine-tune the project scope to validate our staffing and planning?

How might we align on the opportunity itself based on our capabilities and service offerings?

What OKRs, KPIs, or other success metrics matter most and how will we capture them for benchmarked measurement?

Discover

Continuous discovery is the most direct way to de-risk a product—reducing ambiguity, refining the problem space, defining the opportunity, and ensuring we’re building the right thing people will love using. Without this evidence, we’re all just guessing at what’s most desirable and speculating where value might be created. And while it can take many forms, it's essential at every stage of the product/project lifecycle: discovery » definition » development » delivery.

When we’re in discovery mode, we answer questions like:

What is the client organization facing?

What do users want/need? How might we create more value for them?

How might we leverage industry trends and market forces?

How might we differentiate from the competition?

Discovery mode

Discover answers the two most important questions you need to ask when developing new digital products: will people use this product? and will the investment be worth it? Most product innovation efforts fail because they were designed to solve the wrong problem. The “right” problem can be identified when the needs and wants of potential users are overlaid on your organizational objectives, your current state technology and processes, and external market forces.

Research

Understanding users’ needs, desires, context, and mental models, helps us better tailor a product for them. We conduct research using observation, task analysis, and other feedback methods and invite our clients to join us in analysis and synthesis to learn first-hand what matters most to people.

Ideate

Generating and communicating new concepts and ideas through sketches, storyboards, and prototypes helps us move from “possible to tangible”. We articulate how best to transform pain points and bright spots from our research into compelling solutions for validation with users.

Validate

Mitigating the risks of poor market-fit requires evaluative feedback directly from those who will decide your product’s fate: the people intended to adopt it. Getting users’ input early unlocks potential barriers to usage and usefulness and offers insight into adoption, purchase intent, use cases, features, and functionality.

Define

Moving from discovery’s preliminary insights and generative research, definition and critical decision-making requires astute product strategy and foresight.

When we’re in definition mode, we answer questions like:

What rapid exploration and experimentation might best address the needs identified in discovery?

What are the clearest, most critical paths forward?

How do we scope design, development, product, and delivery strategy accordingly?

What are ways of building alignment for priorities, sequence and tradeoffs?

Definition mode

Your dedicated team helps you understand the resources needed, what technologies are available and required, and how to best prioritize with emphasis on speed-to-value. In parallel, we define candidate architecture based on industry best practices and your technical readiness and organizational needs. The resulting design, engineering and product strategies are synthesized into a comprehensive delivery management timeline focused on the specific, critical activities driving the most impactful outcomes.

Prioritize

Defining what comes first, next, and later depends largely on research insights and organizational resources. We believe prioritization is a collaborative act and must provide strategic rationale for milestones, clearly defined outcomes, and a flexible roadmap that’s responsive to iteration,

Assess

Estimating and devising the smartest, most scalable approach for the engineering work ahead requires thorough discussions about build-buy-partner tradeoffs as well as thoughtful consideration of your existing infrastructure, technical ability, and capacity.

Align

Creating a compelling story around the vision, investment, impact, milestones and metrics, we work closely with clients to build alignment and momentum toward leadership buy-in and funding.

Build

It’s not enough to produce a deck full of actionable insights or a beautiful interactive prototype. You have to get your products live and in the hands of your end users to make a real impact.

When we’re in build mode, we answer questions like:

What design, data, and documentation do we need to make in support of development?

How do we best integrate with existing platforms and technology without sacrificing research insights and design intent?

What are our riskiest assumptions and how might we address them with users?

Building mode

We believe close collaboration and constant feedback between designers and engineers help ship the best products. We advocate for small builds, frequent releases, and continuous testing of your riskiest assumptions. Depending on the size and complexity of the solution, it can take several months to launch, followed by multiple iterations to achieve a mature product and conquer the S-curve of adoption.

You’re informed and involved throughout our design, development, and deployment efforts—learning with us in real-time through workshops and discussion and rapid, Agile cycles and ceremonies.

Shape

Structuring data, content and information architecture, designing the user interface and interactions, and creating a beautiful and accessible experience for all, we make certain we’re delivering what’s most valuable to users and feasible for engineering.

Develop

Scoping and shipping “thin slices” of the product means we deliver key aspects of the end-to-end experience in smart, manageable sprint cycles. This thin slice approach meets technical and functional requirements while mitigating risk and building conviction with testable outputs.

Learn

Approaching launch, we continue gathering input from stakeholders and end-users as often as possible—ensuring new features are useful and new interfaces are usable. Additionally, we commence with stringent quality assurance (QA) and user acceptance testing (UAT) letting us analyze, optimize, and enhance design and development to ensure product success and adoption.

Measure

To us, measurement is simply another form of discovery post-launch. With your product live and in the hands of end-users, we’ll see how it's actually being experienced and adopted. And we’ll determine the value it's creating for people and your organization. Analytics, user feedback, sales data, and other metrics give us what we need to ensure your product’s success.

When we’re in measurement mode, we answer questions like:

What are adoption rates and contributing factors?

How is the product performing technically and in-market?

What new features and functionality are ready for design and development?

What are our metrics and analytics telling us?

What transpired since launch and what can we learn and improve?

Measurement mode

Together, we measure outcomes, re-evaluate product priorities, adapt to changing needs, and continuously evolve. Before transitioning into any next phase of work, we host a project retrospective with key stakeholders to refine OKRs and/or KPIs and develop a shared approach to ongoing testing, evaluation, and validation of program success. We also identify project pain points and bright spots—ensuring “lessons learned” are documented for assessment and action.

Research

Conducting post-deployment research we gather new insights from real world user feedback. This input builds on prior discovery work and deepens our understanding and empathy for users while inspiring new ideas for future features and functionality for the next product release.

Benchmark

Leveraging third-party data collection and research tools, we validate UX objectives and establish post-launch benchmarks for internal and external audiences. Working with your analytics team, we track any movements from baseline and mid-project data collection to verify the product is assessed on quantitative as well as qualitative performance indicators.

Support

Monitoring your initial deployment, we guarantee stability and defect remediation while we transition the product to your internal teams—or help you build a team to take ownership. Additionally, we can assemble lean team models for smaller project-based enhancements until you’re prepared to begin work on the next major release.

Let's shape your insights into experience-led data products together.